DENVER — As you’re out holiday shopping, one legal expert warns to keep an eye out for buy now, pay later (BNPL) plans. With tighter budgets, they can look enticing as they can split large purchases into smaller, more manageable ones over a monthly basis.

However, the lawyer Denver7 spoke with said BNPL plans can easily rope you into more debt, and there aren’t many protections in place to keep you out of trouble.

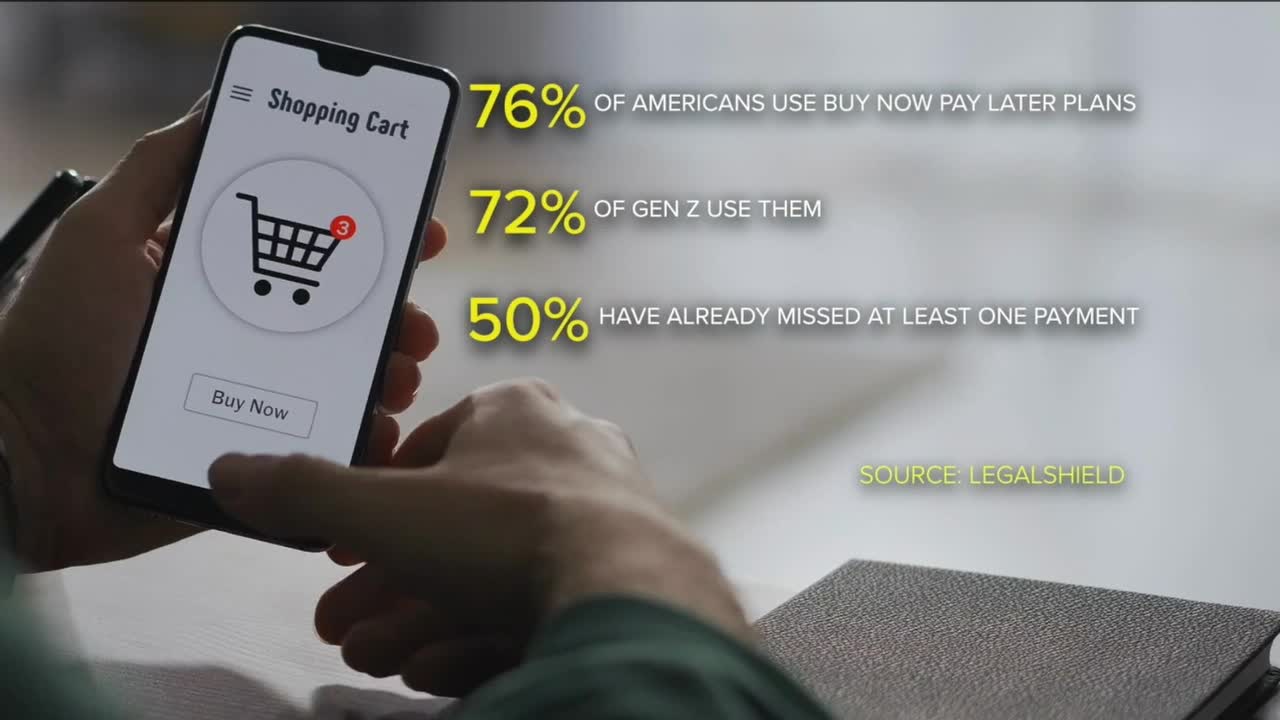

76% of Americans use BNPL plans, 72% of GenZ uses them, and 50% of users have already missed at least one payment, according to LegalShield.

Rebecca Carter is a principal at the law firm Friedman, Framme & Thrush. Carter told Denver7 she is seeing more people calling her office asking for advice after falling into debt with buy now, pay later plans. She said there’s not much that can be done legally after you’ve signed the terms.

“It's not as though [these companies] are doing anything unlawful,” Carter said. “Protection really comes in with spreading education and understanding the potential for penalty. I wish there was more, but [there’s not].”

Prices for all goods rose 0.3% in September after rising 0.4% in August, according to the latest Consumer Price Index report. It continues a trend of rising inflation amid interest rate cuts aimed at jump-starting a slowing job market.

It has made holiday shopping budgets tighter this year, so Carter said to be mindful and educate yourself and your kids about these plans.

“Creditors have an interest in getting paid back,” Carter said. “You have an interest in preserving your credit, you know, and trying to be proactive earlier on.”

She said it can be easy to find yourself over-spending when you rely on BNPL plans and then finding yourself in credit trouble down the road.